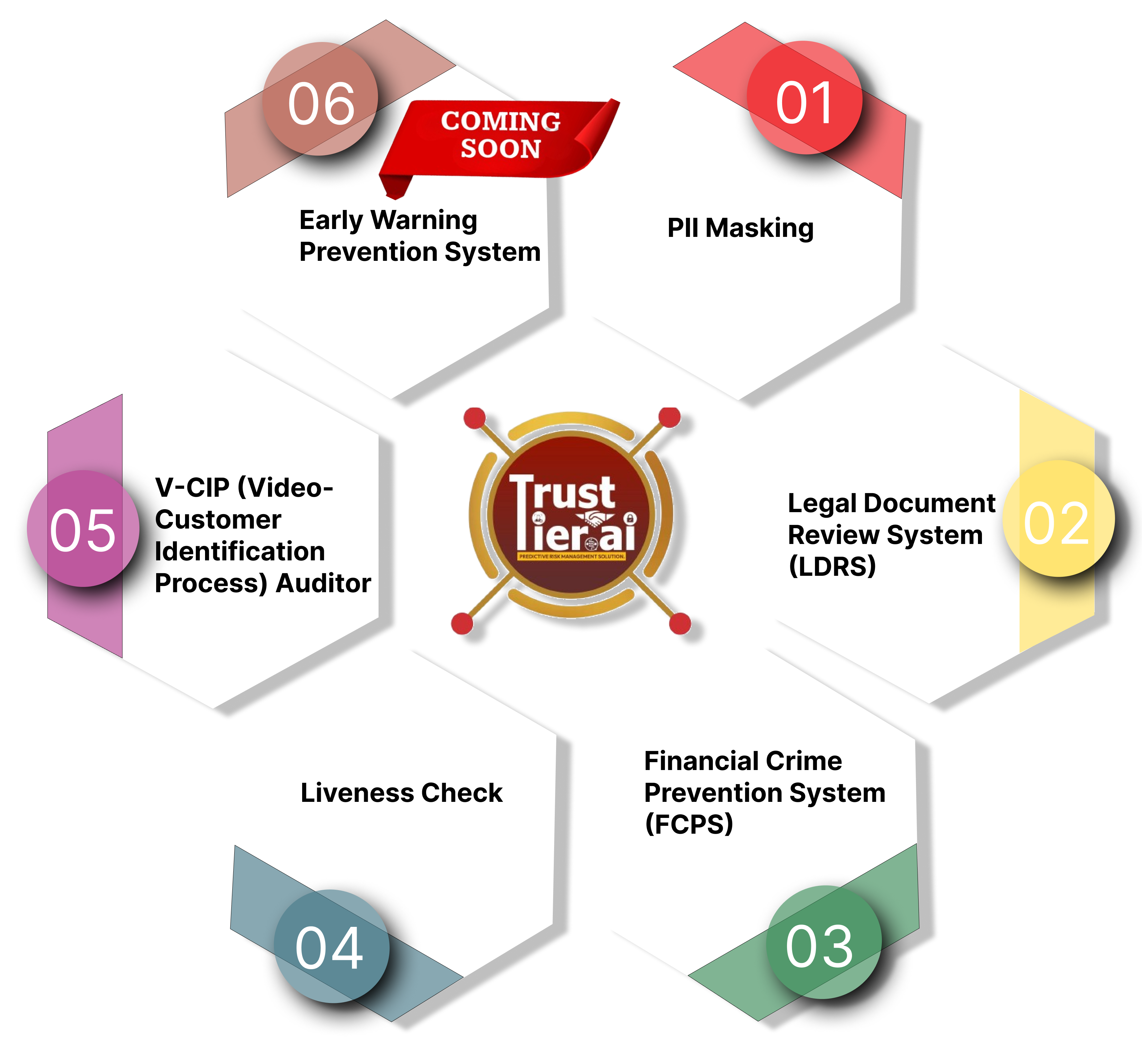

Trust Tier AI

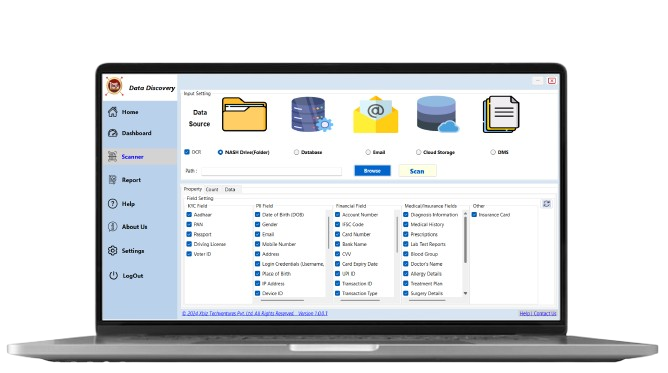

TrustTier AI revolutionizes risk management in Banking, Financial Services, and Insurance with advanced data analysis, detecting fraud and compliance issues, securely masking Aadhaar and other PII information, and ensuring robust security and compliance with AI-based Automation.